Tsp matching calculator

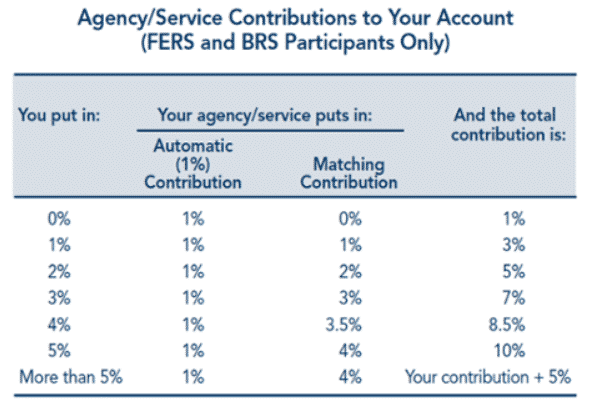

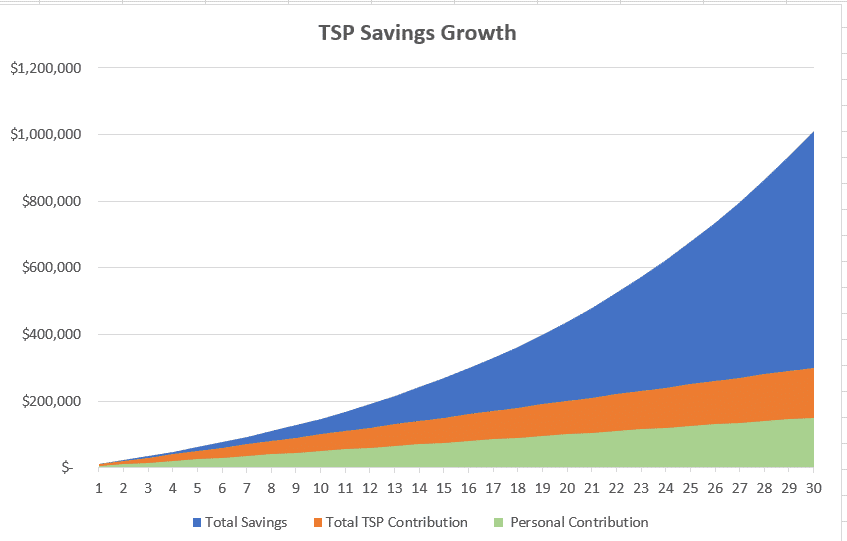

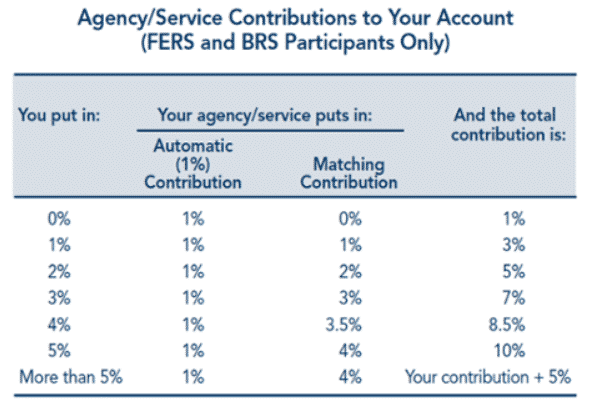

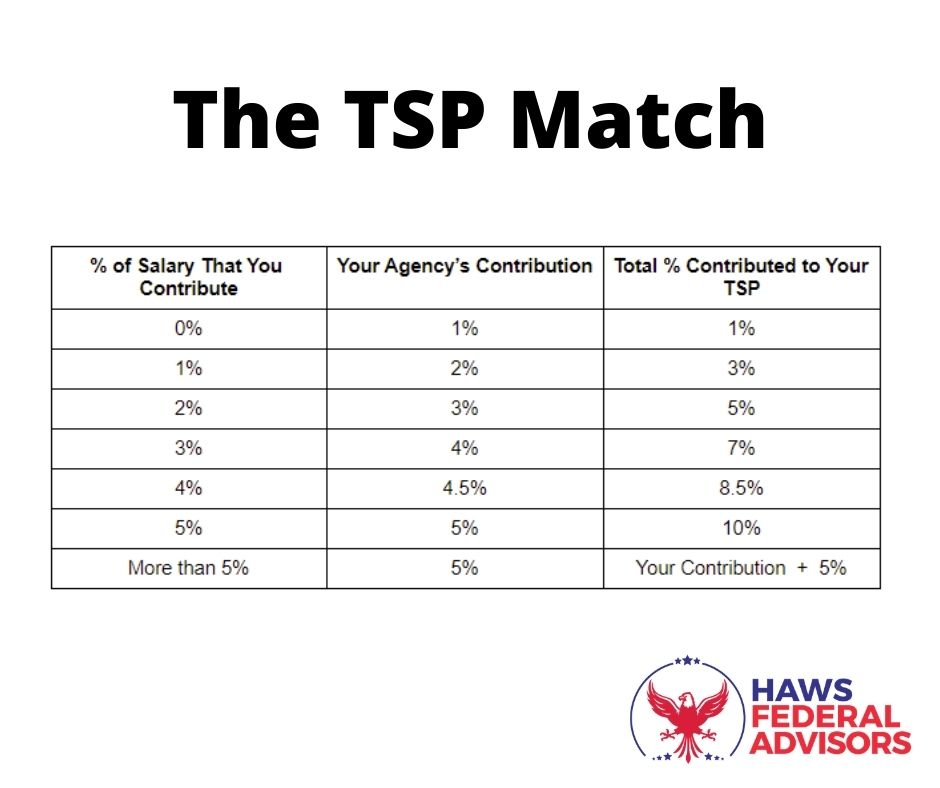

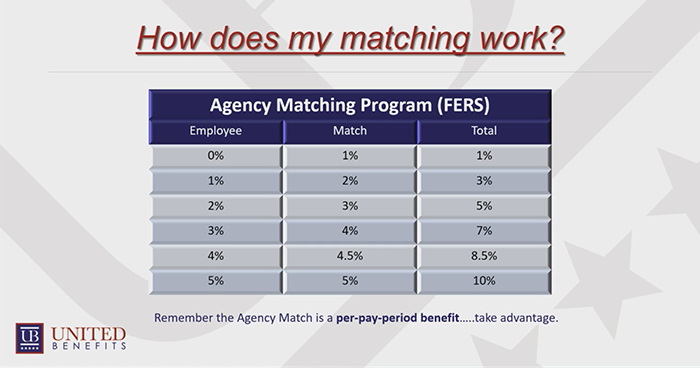

The annual contribution limit for workplace retirement plans like 401ks 403bs most 457s and the governments Thrift Savings Plan TSP stands at 20500 in 2022. You can also make your own contributions to your TSP account and your agency will also make a matching contribution.

Tsp Archives Military Financial Advisors Association

This post acts as a quick military pension calculator for guidance on how to best build your retirement savings.

. Study with Quizlet and memorize flashcards containing terms like 1 Key information youll need when using the BRS calculator to help a Service member with retirement planning includes _____ 2 A critical role of the FCE will be to advise eligible Service members whether to stay in the legacy High-3 military retirement system or opt into the Blended Retirement System 3. We also have a great retirement plan a 401k-type plan with matching contributions excellent vacation benefits a wide array of healthcare plans fitness centers and much much more. Oz to cc converter.

Apply to Customer Care Specialist Transportation Officer Order Filler and more. An unpaid TSP loan may delay disbursement of the TSP account balance. Court Rejects Suit over Delayed TSP Matching during 2018-2019 Shutdown.

Each year the IRS determines the maximum amount you can contribute to tax-deferred savings plans like the TSP. Ounces to grams converter. Use our easy Free online milligram to milliliters converter to convert your units from the milligram mg to milliliters ml.

Service members now have two retirement options with the new Blended Retirement System BRS. The OTP delivery will depend on the Telecom Service Provider arrangements with TSP at respective places. However subscriber charges for International roaming will apply.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. You will also have an opportunity to work for one of the premier organizations in the nation specializing in the broad field of labor economics and statistics. The pay date is the deciding factor of what year your TSP contributions count towards.

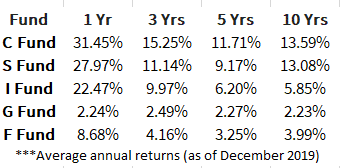

The money you save for retirement in a defined contribution plan is invested in. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees. You can use the online student loan consolidation calculator here.

If a member only contributes 3 of their basic pay to the TSP the government matching contribution will be 3 and so on. For example if your last pay period ends in December but pays in January then that TSP contribution is considered to fall in Januarys tax year. 20 years of service to transition out of the military and still receive some transferable benefits in the form of the matching TSP.

Complexity of an incident. To determine the adjusted amount use the Elective Deferral Calculator on the TSP website. Government automatic and matching contributions of up to 5 of basic pay to your Thrift Savings Plan TSP account.

The calculator assumes your minimum contribution is 6. If you choose not to withdraw your funds in the event of your death the TSP Service Office would pay the funds based on your written designation form. TSP Responds to Customer Service Complaints.

We are a global semiconductor company that designs manufactures tests and sells analog and embedded processing chips. This is known as the IRS elective deferral limitParticipants should use this calculator to determine the specific dollar amount to be deducted each pay period in order to maximize your contributions and to ensure that you do not miss out on Agency or. All covered members receive a Government contribution that equals 1 of basic or inactive duty pay to a tax-advantaged retirement account Thrift Savings Plan TSP after 60 days following the entry into Uniformed Service.

2022 Military Pay Charts. Dollar figures are rounded to the nearest hundred. A defined contribution plan is an employer-sponsored retirement plan funded by money from employers and employees.

The TSP part of FERS is an account that your agency automatically sets up for you. The way the program works is that after making 120 monthly and on-time consolidated and reduced payments your remaining balance. AARP 401k Savings Planning Calculator.

In computer science and operations research the ant colony optimization algorithm ACO is a probabilistic technique for solving computational problems which can be reduced to finding good paths through graphsArtificial ants stand for multi-agent methods inspired by the behavior of real antsThe pheromone-based communication of biological ants is often the predominant. As long as you are contributing at least 5 of your bi-weekly gross pay each pay period you will receive the 4 Agency Matching contributions each pay period. Ml to tsp converter.

Frustrating Debut for New TSP Account Setup Features. This calculator is programmed to account for this. To enter the special character please press Alt Key first meanwhile enter the matching digits next to the special character then release Alt Key.

1 A milliliter is equal to one-thousandth of a literIt is also equivalent to 1 cubic centimeter or above Milliliterut 15 minims. Additionally you will receive the Agency Automatic 1 contribution each pay period. A one-time midcareer bonus in exchange for an agreement to perform additional obligated service.

Texas Instruments has been making progress possible for decades. M to ft converter. Each pay period your agency deposits into your account amount equal to 1 of the basic pay you earn for the pay period.

This hypothetical illustration assumes an annual salary of 75000 pre-tax contribution rates of 6 and 10 with contributions made at the beginning of the month and a 6 annual effective rate of return. Your employer will provide you with information about your withdrawal options and the option to keep your money in the TSP. Milligram mg is a little unit of mass in the metric scheme which is 11000 of a gram 0001.

Please make sure to use the number input panel on the RIGHT SIDE of the keyboard to enter the numbers. OTP will be sent only to the registered mobile number if the registered Mobile number is enabled for International Roaming OTP will be delivered. The catch-up contribution amount for these plans is currently 6500.

Eligibility for FERS. 401k and Other Workplace Retirement Plans.

Tsp Calculator Thrift Savings Apps On Google Play

Grow Your Retirement Savings With Your Thrift Savings Plan

Grow Your Retirement Savings With Your Thrift Savings Plan

What Is The Difference Between Traditional Tsp Roth Tsp United Benefits

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Tsp Contribution Limits 2021 How To Maximize Your Tsp Savings

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Max Your Tsp Contributions 2021 Percent Of Pay To Contribute To Receive 5 Match And Contribute 19 500 By 31 Dec R Militaryfinance

Tsp Calculator Thrift Savings Apps On Google Play

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Tsp Contributions And Funds Youtube

Are You Maximizing Your Match Marine Corps Community

Tsp Contribution Calculator R Militaryfinance

Is Roth Tsp Worth It Government Deal Funding

How Thrift Savings Plan Matching Works United Benefits

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid